Disclaimer: This review is shared purely with the intention of helping others make informed decisions. It is not sponsored, and we do not receive any commission or benefit from it. We genuinely believe in sharing valuable information that could support and benefit the community.

Table of Contents

Introduction

The numbers are sobering: Almost two-thirds of Americans would fail a basic financial literacy test, and the average student loan borrower has more than $37,000 in student loans. In the meantime, credit card debt of young adults is ever increasing and lots of them come to twenties being not financially prepared to meet the conditions of adult life.

Never before has financial education been so important for teenagers. Traditional high school curricula and schools do so rarely sufficient to prepare students for managing money in the real world. Parents and educators are seeking programs which can bridge a gap between theoretical to actually a practical plan.

Out of all the options, a distinct educational tool, that is, “Beyond Personal Finance”, has been established which holds the promise of being very effective to model 20 years of adult financial decisions in only 20 interesting and engaging lessons.

But does the program really deliver?

In this in-depth “Beyond Personal Finance” review, I will outline how you can decide if Beyond Personal Finance is the program to take your teen, and look at the strengths and weaknesses of the program with the openness you require to make the correct choice.

Understanding Your Needs as a Parent or Educator

Whether you are a parent, a homeschool educator, or a traditional teacher, if you are reading this article, you are probably aware of a basic dilemma: traditional methods for teaching teens about money often don’t stick. let's first discuss these challenges:

- Your teenager knows the simple principles such as budgeting theory but cannot practice them.

- You know it’s important to teach your child about financial independence, but you aren’t sure how to convey the lessons you’ve learned the hard way.

- Lectures and traditional text books appear to enter one ear and leave the other, so how to make them understand.

- You worry that your teen will commit some expensive financial mistakes in college and after

- You want a structured curriculum, but don’t have 70 hours to learn to be a financial educator.

- What you want are self-paced materials, where the students can learn at their own pace.

- You want something more comprehensive than simple budgeting worksheets.

- What you want is a program that meets high school credit guidelines and is actually useful in practical life as well.

- You would like to enhance classroom learning with some practical learning experiences.

- You must have materials which will interest the students who usually do not care about financial matters.

- You want materials that illustrate practical implications without the practical risks.

You would like to assist students in seeing the financial choices as long-term consequences.

Who is this Article for?

This review is particularly for:

- Parents of teenagers between the age of 13-18 who are interested in making sure their children are financially ready to become adults.

- Homeschool teachers in search of a rich personal finance program.

- Educators who want to improve their financial literacy curriculum.

- Youth leaders and guidance counselors that deal with college-bound students.

- Anybody charged with the responsibility of equipping teens with good financial decision making.

What Is Beyond Personal Finance?

Beyond Personal Finance is a curriculum (choice based) developed by Charla McKinley to teach teens most important things about money management, starting with college and career planning and continuing on to marriage, buying a house, managing unemployment, paying tax on income, monitoring investments and other important factors of life that influence money. Check the below link to view class introduction video.

About the Course Creater

Charla McKinley is creator of “Beyond Personal Finance”. She is a University of Texas graduate, having finished with a degree in Finance and is a Certified CPA having more than 25 years of experience in the corporate and private sector. Her profound financial background coupled with her interest in young education made her create this interactive curriculum especially to the teenagers. McKinley was motivated by the fact that most financial education programs are geared towards adults that are already in a poor financial situation, and teens can hardly relate to the content. She calls Beyond Personal Finance a "smash-up of Dave Ramsey and the Game of Life," together with sound financial concepts presented in an exciting, game-show type style that appeals to the younger students.

How the Curriculum is Designed

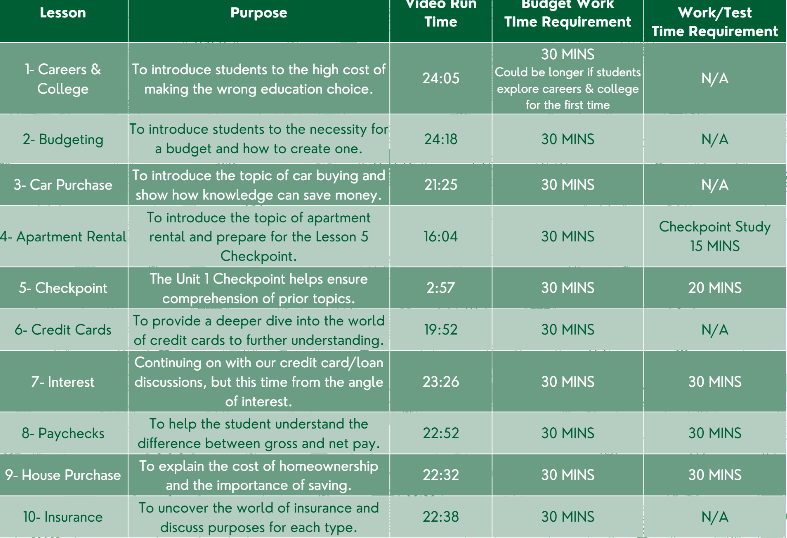

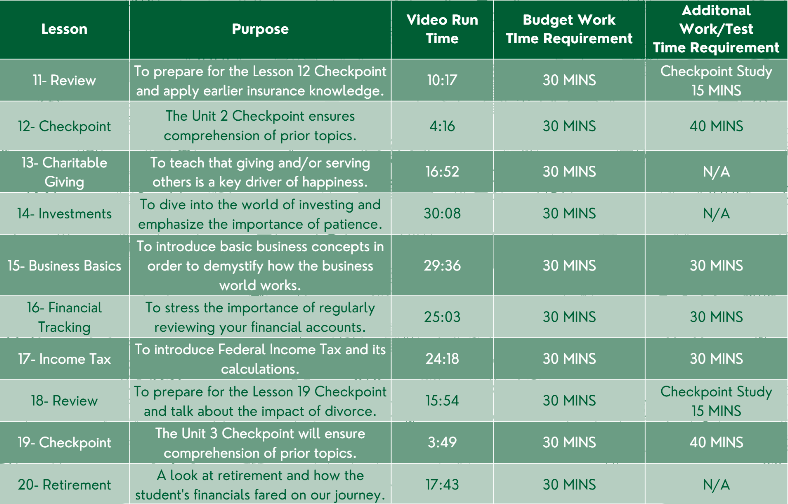

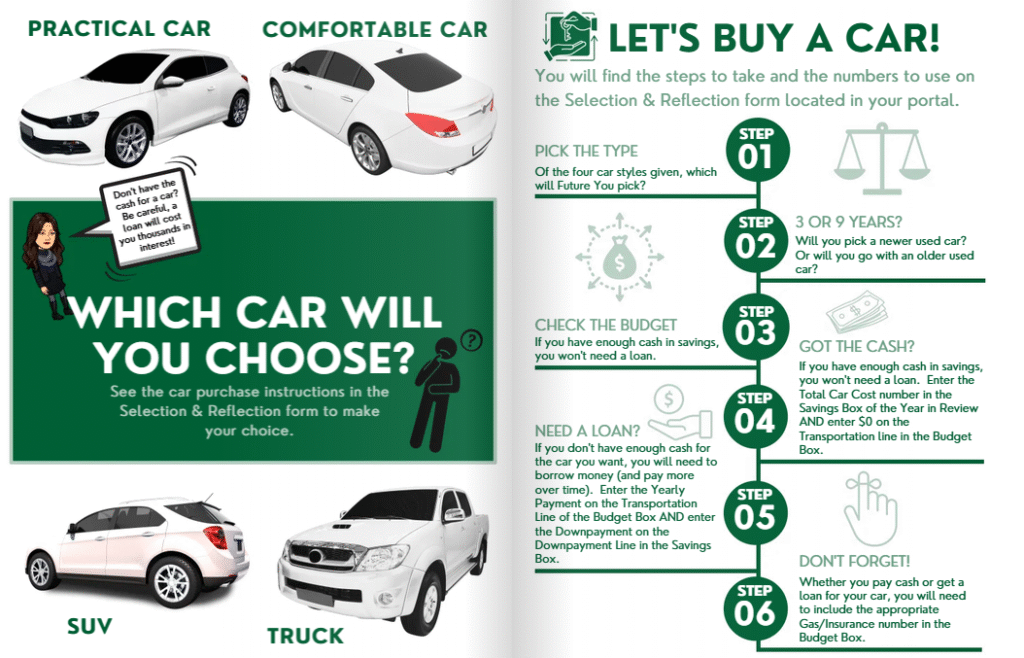

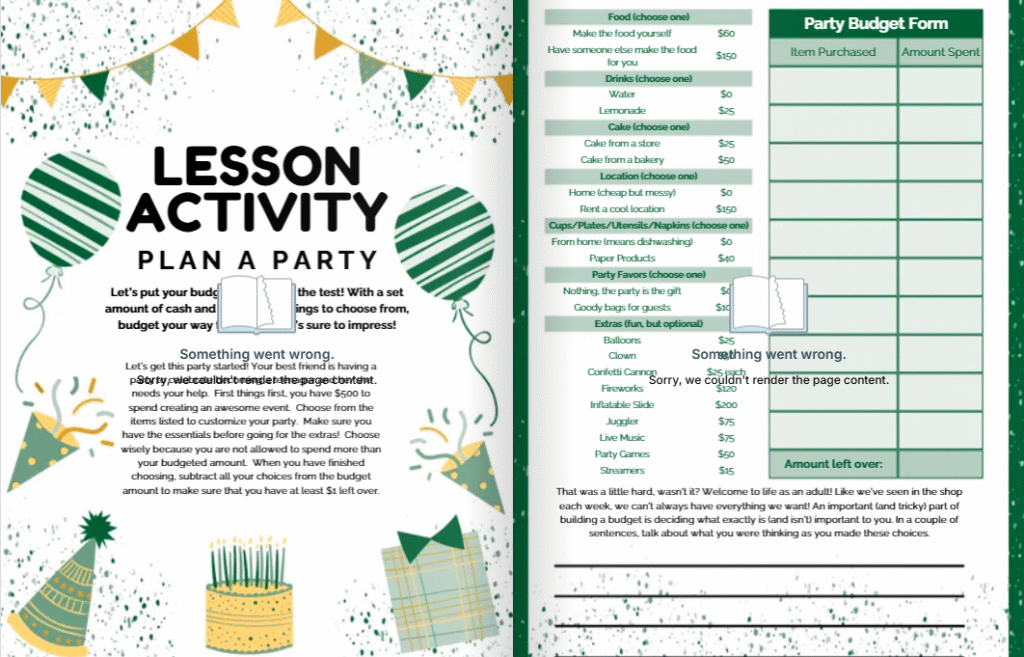

Beyond Personal Finance represents a curriculum by choice that makes the student open his/her eyes to the high cost of becoming an adult by taking an interactive, informative, 20-lesson, self-paced course that puts the student into the world of being an adult and then the challenges they will face in their future by allowing them to live it themselves between 22 to 42.

Beyond Personal Finance curriculum is comprised of:

- Video lessons online with real life situations

- Interactive decision modules

- Online worksheet and calculators

- Progress monitoring tools

- Comprehensive printable workbook

- Reference materials and charts

- Assessment materials

What is Special about Beyond Personal Finance

The Simulation Approach

One of the things that makes Beyond Personal Finance stand out is the life simulation methodology. Rather than being taught in isolation, students manage a bigger story across Beyond Personal Finance, affecting the little elements of the game that accumulate over time.

How the Simulation works making it like a Real Life?

Students will have a chance to:

- Decide on a preferred path after high school, whether it be attending college, enrolling in trade school, or entering the workforce immediately and so on.

- Select careers based on choices made in the education section, despite correct salary expectations.

- Select housing, transportation, insurance, lifestyle choices, etc.

- They marry, have children, change jobs, and experience economic downturn.

- They see how their past decisions can impact on their financial present and future.

Real Consequences, Safe Environment

The simulation generates real learning experiences as it demonstrates students the real prices of their decisions. Consider a student that has chosen a high car payment as an example. This decision will affect several lessons later in the program when students do not understand cover other expenses or save targets.

Traditional vs. Experiential Learning

Experiential learning is far better when compared to the traditional learning. The experimental model reflects the manner in which adults in the real world learn about money through decision making, having consequences, and modifying behavior as a result. Here is the comparison between traditional and experiential learning.

The old-fashioned financial education can take a lecture-and-worksheet format:

- Teacher introduces concept (budgeting, e. g.)

- Students solve exercise problems

- A test is taken by the students

- Students forget the concepts as there was no real-life practical scenario.

Beyond Personal Finance reverse this concept:

- Students are presented with a real-life scenarios where finance decisions need to be made.

- They seek information and choose what to do according to their situations.

- In the following lessons, they face the results of their choices.

- They change their tactics with results.

- They do not forget knowledge due to the fact that it is associated with self-experience.

Click here to view sample lesson pdf.

Click here to view Sample Video Lesson.

Beyond Personal Finance - Strength and Limitations

No program is 100% perfect, and Beyond Personal Finance is no exception. While it offers significant benefits, it is important to understand both strengths and its limitations. Below is a detailed examination of the Beyond Personal Finance key advantages and areas for improvement.

Application Focus

- Students get to know how to do it actually, not memorize only.

- Decisions made have realistic results that accumulate with time.

- Includes situations that teens will actually face in adulthood.

- Incorporates several financial concepts as opposed to teaching in isolation.

Self-Paced Learning

- Learners are able to take more time on the difficult ideas.

- High level learners are able to navigate through content fast.

- Various homeschool and classroom needs are met by flexible scheduling.

- Specifically targeted to teens Age 13 and up, raising awareness on key aspects of finances in an interactive and realistic scenario.

Engaging Format

- The student interest is held by game-like elements.

- Choice based learning enhances interest.

- Video contents attract visual learners.

- The presence of interaction features eliminates passive usage.

Comprehensive Coverage

- Covers simple and complicated financial principles.

- Covers the topics that are frequently missed in other programs (insurance, taxes, investing).

- Relates life goals and values with the financial decisions it makes.

- Connects financial decisions to life goals and values.

- Includes material, unforeseen circumstances and financial difficulties.

Independence Building

- Students take their own choices and bear the consequence.

- Develops trust in the financial judgments.

- Fosters money decisions.

- Equips students with independent living in the real world.

Educator-Friendly Design

- Minimal preparation is needed on the part of the teacher.

- It is targeted at high school and middle school teenagers who are well versed with decimals percent, fractions, and simple algebra.

- Included are assessment tools and progress monitoring.

- It is appropriate to parents who do not have wide knowledge in the field of finance.

Cost Factor

- The individual self-paced financial curriculum is priced at 150 dollars.

- There can be extra charges applicable to multiple students or classroom licenses.

- It’s actually a large expense when there are free options available.

- Not everyone in the family or school budgets may afford.

Self-Discipline Requirements

- Learners have to be encouraged to work through lessons on their own.

- No outside accountability unless it is parent/teacher monitored.

- There are students who are in hurry can skip some lessons.

- Needs regular engagement over long duration of time.

Technology Dependence

- Videos need stable internet connection.

- Will not suit students that like conventional learning through textbooks.

- May pose difficulties to families that have low access to technology.

- Not everyone might prefer learning in digital format.

Limitations of Learning Style

- May not be better for students who are comfortable through direct teaching.

- May be challenging for students who are struggle in decision-making.

- Could be overwhelming to students that like to be guided step-by-step.

- Will not be structured enough to accommodate all learners.

Scope Considerations

- Deals more with personal finance than with economics in general.

- Probably cannot fulfill needs of extensive economics courses.

- Low coverage of the business finance or entrepreneurship content.

- Does not vastly discuss international financial concepts.

Who Should Consider “Beyond Personal Finance”

- Independent and self-motivated learners that are self-driven and able to attend to online materials.

- Decision making teens who love making decisions and observing results.

- Students planning to go to college, who must realize the financial facts and realities of college life.

- Homeschool students that thrive on flexible comprehensive curriculum.

- Individuals who prefer to learn through interactive contents as compared to traditional ones like textbooks, sheets.

- Tweens aging from 8 12 or teens aging from 13+ who are just starting to consider in earnest their life after high school.

Who Shouldn't Consider “Beyond Personal Finance”

- If you are a learner that prefer traditional classrooms learning and direct instruction from educators.

- If your family has an extremely low access to technology.

- Students that are not going to college and require more trade- oriented financial advice.

- Teenagers that already work and require urgent practical skills.

Still Confused? Here is the Check-list for you

If you are still confused whether you should go for “Beyond Personal Finance”, below is the check-list for your help.

Student Readiness

- My teen is able to complete online assignments and course work independently [Yes/No].

- My teen likes to make decisions and to observe the outcomes [Yes/No].

- My teen has simple mathematics knowledge (decimals, percentages, simple algebra) [Yes/No].

- My teen is keen to make his life better with good financial planning [Yes/No].

- A teenager is capable of dealing with appropriate financial principles [Yes/No].

Family/Classroom Fit

- We have stable internet and proper technology [Yes/No].

- My teens like to make decisions and to observe the outcomes [Yes/No].

- We can give 1-2 hours a week to this curriculum [Yes/No].

- The 150 dollars price is affordable to our education budget [Yes/No].

- An adult is available for further discussions with Teen [Yes/No].

- We would choose a complete curriculum rather than a fragmented resource [Yes/No].

Educational Goals

- We want real world practical financial skills, not only conceptual information [Yes/No].

- We prefer action and simulation-based learning methods [Yes/No].

- We need a complete curriculum, not add-ons or supplemental resources [Yes/No].

- We want to make our teen ready for college and early adult financial challenges [Yes/No].

- We want our teen to focus on personal finance rather than broader economics [Yes/No].

Alternative Considerations

- We have checked the free options and they are not sufficient and good enough [Yes/No].

- We choose self-contained curricula instead of the volunteer or educator-based ones [Yes/No].

- We desire something that is targeted to the teenage group and not modified adult content [Yes/No].

- We require flexibility in pace and time [Yes/No].

Final Decision

- If the answer of majority of questions is “Yes”, Beyond Personal Finance will be a worthwhile investment to your teenage finance education. The strengths of the program suit your needs and situation.

- In case answer of a few of the questions is “Yes”, we recommend trying a free version first, or check the possibility of your school and then may be you can go for Beyond Personal Finance. Similar programs are provided in the district. You can also look at single modules with other providers.

- In case answer of few questions is “Yes”, Beyond Personal Finance might not be the most suitable one. Think of more formal options like Foundations in personal finance course such as those offered by Dave Ramsey or a volunteer financial literacy mentor in the city.

Recommendations

So, finally, you have decided to try “beyond personal finance”, here is what you need to do when you have the access to the course.

Getting Started:

1. At least have a look at the initial lessons yourself to get the idea of the format.

2. Create a favorable work environment with a strong internet connection.

3. Make it routine (2-3 lessons a week is a good rule to follow in most families).

4. Allow 30-60 minutes per lesson, plus discussion time.

Maximizing Effectiveness:

1. Discuss the decisions and arguments of your teen.

2. When possible relate lesson content to actual family financial choices.

3. Use the workbook materials for reference and reinforcement.

4. Ask your teen to bring his major decisions to you, so he can practice some more.

Want to take the Next Step

In the event that Beyond Personal Finance looks like a good match after this review:

1. To preview sample lessons go to the official site of Beyond Personal Finance.

2. Talk to your teen about time requirement and expectation

3. Make sure you are equipped with the technology and the internet

4. Think in advance how you will combine talks and assistance with the learning process.

Still Uncertain?

In case you are still not certain about Beyond Personal Finance, these could be suitable options for you:

- See what free options, such as Next Gen Personal Finance, Junior achievement or other volunteer programs in the area.

- Ask your school district regarding financial literacy programs.

- You can begin by simple budgeting applications or tools to know the interest of your teen.

Money matters too much, financial education is not the thing to be left to chance. Either with Beyond Personal Finance or through any other quality program, and investment in financial literacy of your teen will soon pay dividends for whole life.